📰 Latest News

Get the latest cryptocurrency news and discover the best trading platform referral codes

Market Update September 5: Price Predictions for BTC, ETH, XRP, and More

Analysis of cryptocurrency market dynamics and investment advice for September 5.

Are Precious Metals the True 'Digital Gold'?

Crypto Biz: Is bullion the tru

ETH Price Rally Remains Strong Amid US Macro Concerns

ETH price rebounds strongly, boosting investor confidence amid market uncertainties.

Bitcoin Faces Jobs Test as Tether Considers Gold Mining

Bitcoin Faces Jobs Test as Tet

Sora Ventures to Buy $1B in Bitcoin With New Treasury Fund

Sora Ventures plans to purchase $1 billion in Bitcoin, enhancing its position in the Asian market.

Upcoming Payroll Data Could Trigger 4% Movement in XRP and SOL

Payroll data release could lead to a 4% movement in XRP and SOL, urging investors to stay vigilant.

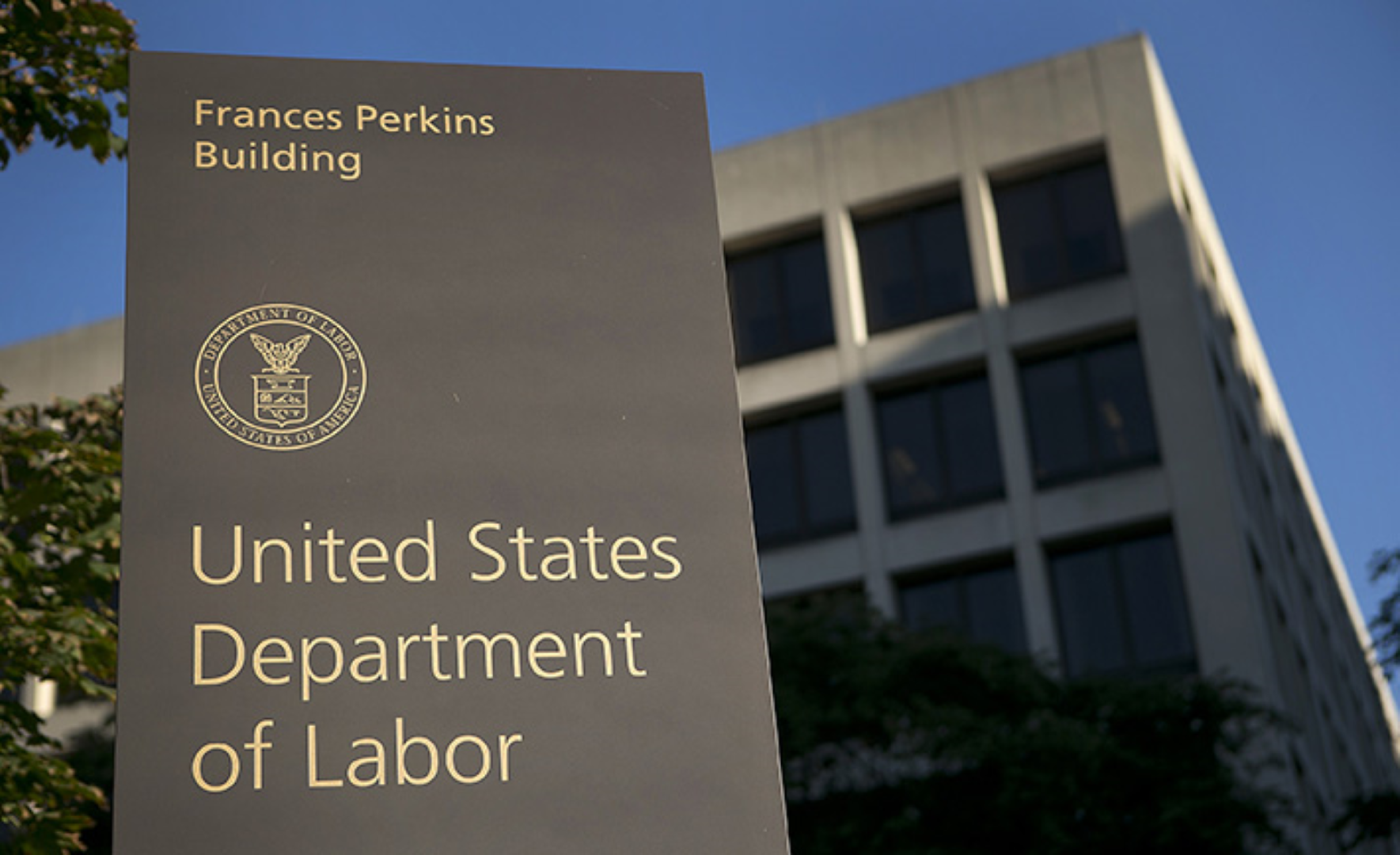

U.S. Added Only 22K Jobs in August as Unemployment Rate Rose to 4.3%

The U.S. August job data disappoints as unemployment rises to 4.3%, with expectations for a larger Fed rate cut.

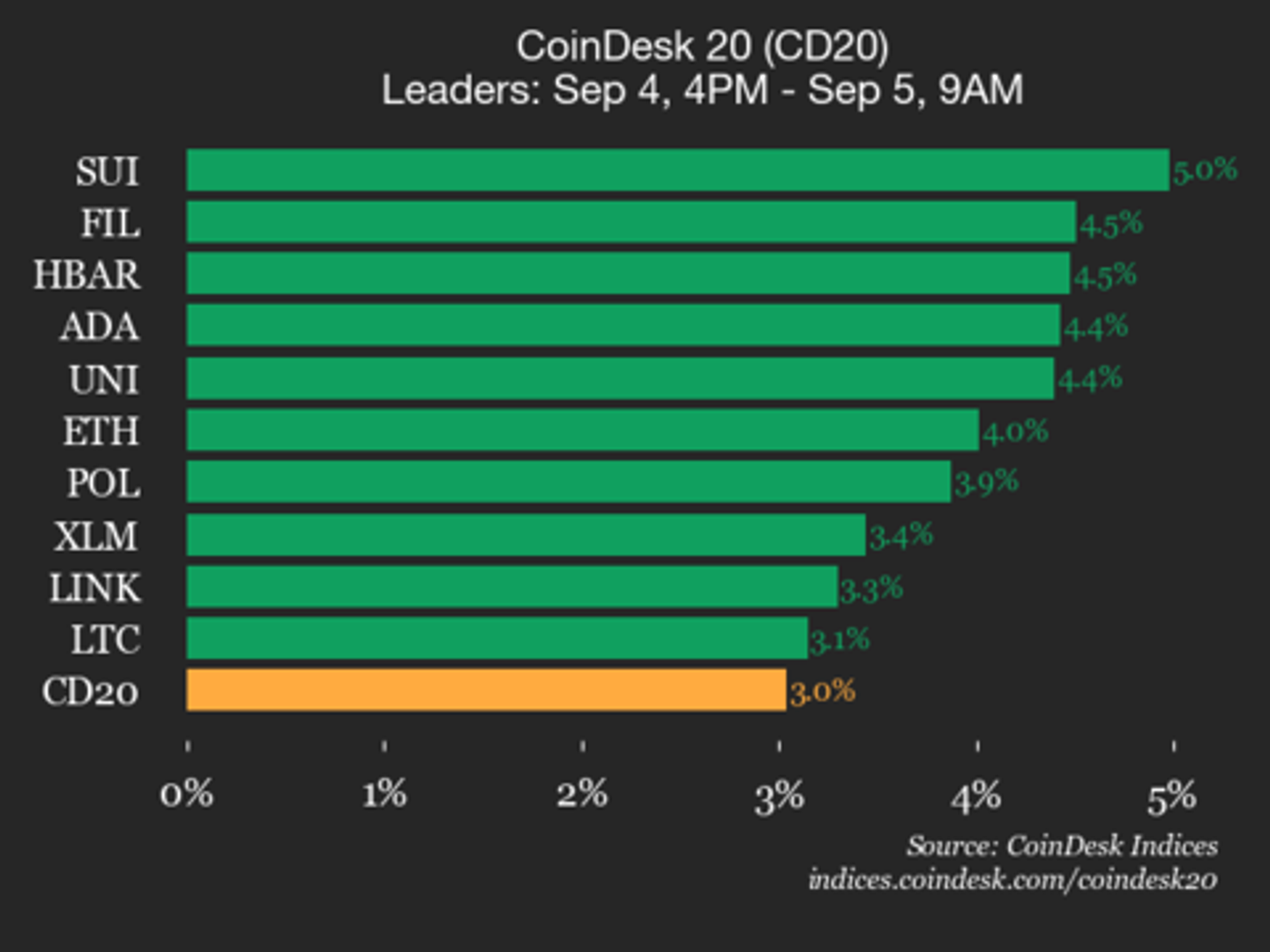

CoinDesk 20 Index Up 3%: Market Shows Signs of Recovery

The CoinDesk 20 index rose by 3%, reflecting market recovery and boosted investor confidence.

Trump-Backed Thumzup Plans to Add 3,500 Dogecoin Mining Rigs with Dogehash Acquisition

Thumzup plans to acquire Dogehash, adding 3,500 Dogecoin mining rigs to enhance market competitiveness.

SEC and CFTC Leaders Unite to Advance Crypto Regulation

SEC and CFTC leaders announce collaboration to advance crypto regulation, presenting new opportunities for the market.

Tokenization Leads the Wealth Management Revolution, Bank of America Calls it 'Mutual Fund 3.0'

Bank of America claims tokenized money market funds will lead the new wave in wealth management.

HBAR Drops 2% Despite Wyoming Stablecoin Adoption

HBAR drops 2% despite Wyoming's support for its stablecoin, reflecting weak market confidence.

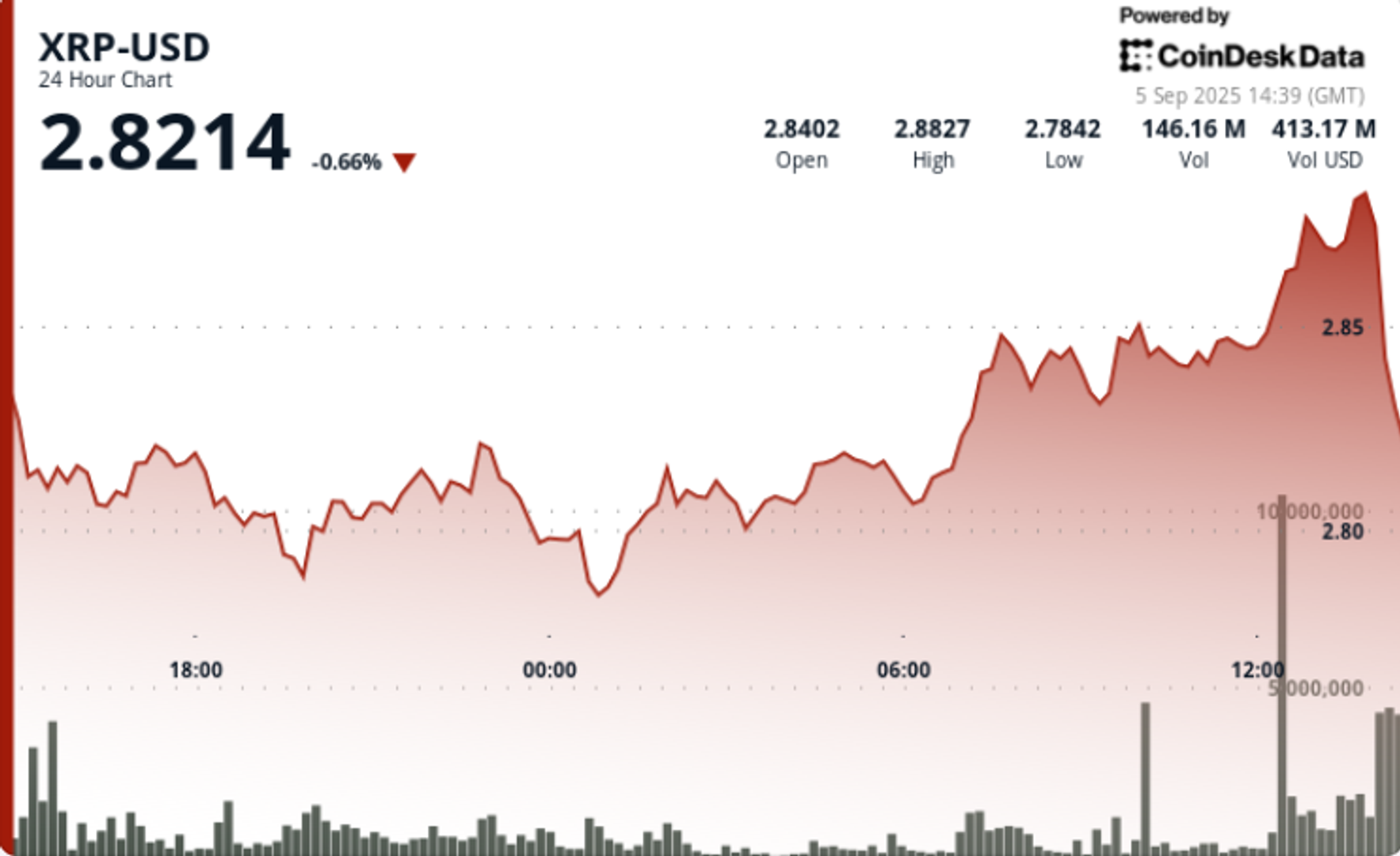

XRP Drops 4% After $2.88 Rejection as ETF Speculation Grows

XRP drops 4% as institutional buying and ETF speculation reshape market dynamics.

Ethereum Leads Crypto Prices in Shocking Reversal After Brief Rally

Weak U.S. job data leads to a brief crypto rally followed by sharp declines, with Ethereum leading the downturn.

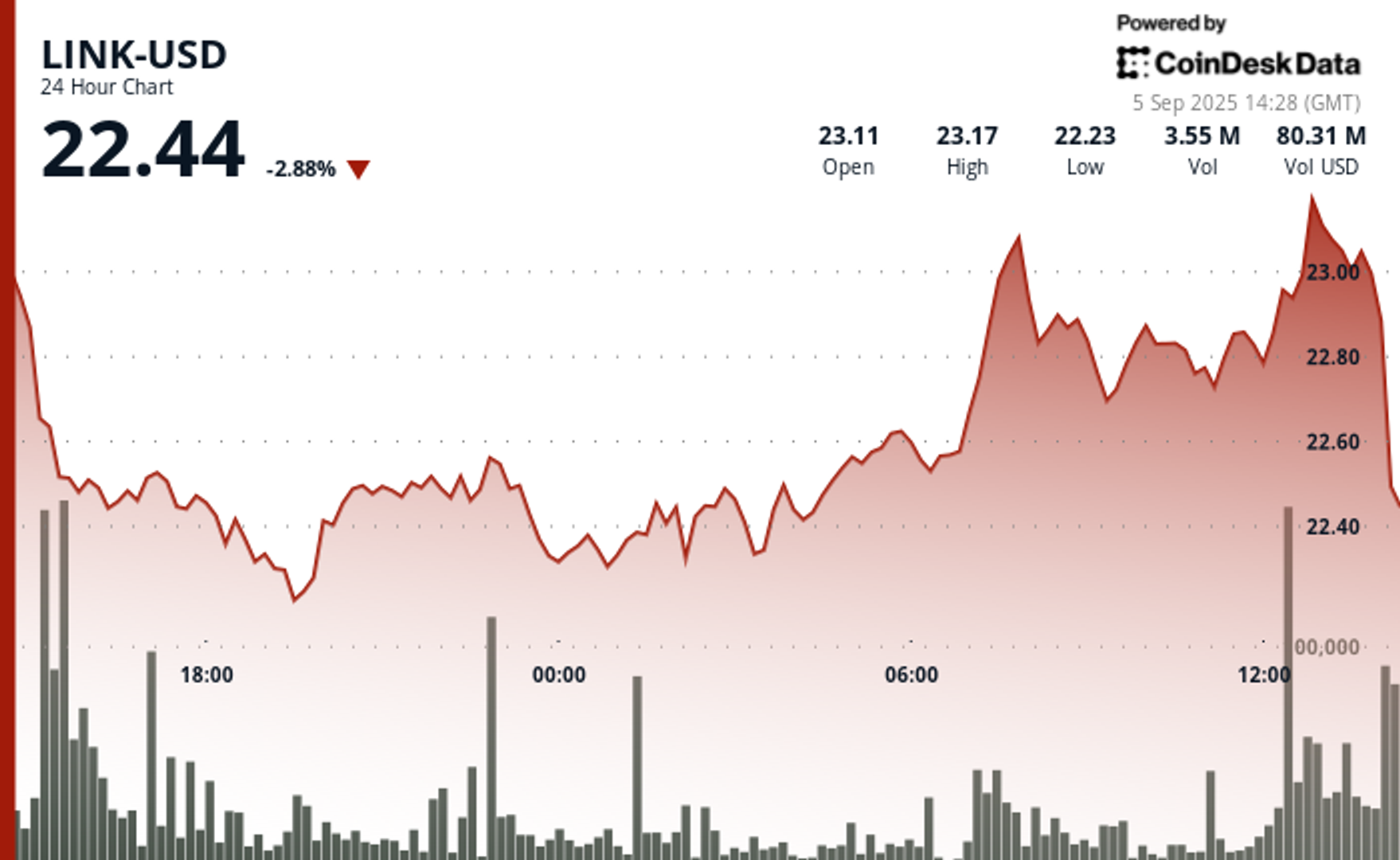

Chainlink Price Drops 15% Amid Market Consolidation, Token Circulation Adjusted

Chainlink experiences a 15% price drop amid market pressures; investors should stay cautious.

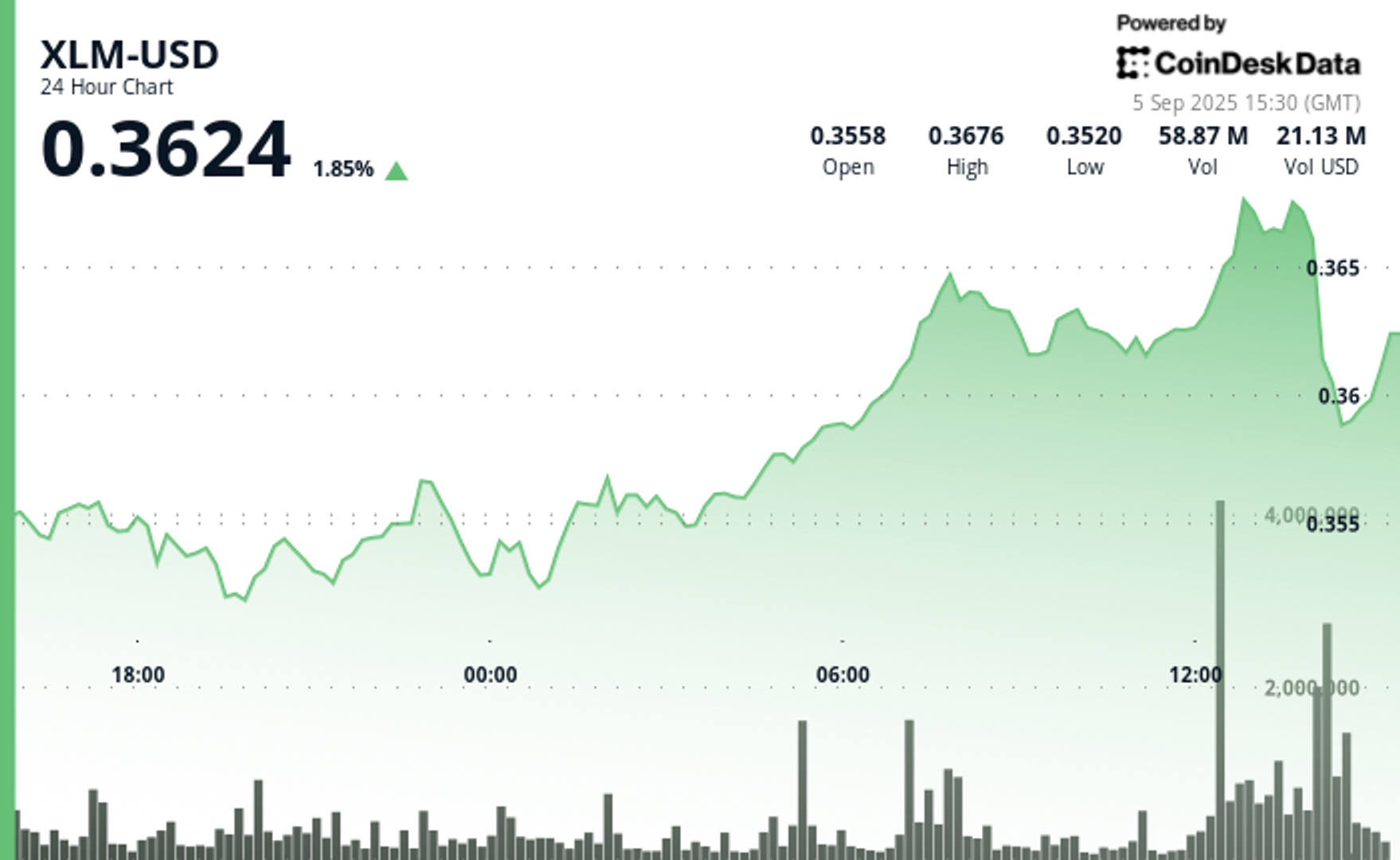

XLM Surges 5% Before Dramatic Final-Hour Collapse

Stellar (XLM) surged 5% before a dramatic decline in the last hour, increasing market volatility.

WLFI Incident Raises Concerns: Who's Next?

The WLFI incident raises concerns about future safety, urging investors to choose trading platforms carefully.

Trump Jr.-Linked Firm Aims for Dogecoin Mining with $50M Fund

Thumzup Media Corporation, linked to Trump Jr., targets Dogecoin mining with $50M funding to reshape the market.

Tether Explores Gold Mining as New Front for Crypto Profits

Tether plans to invest in gold mining, seeking new opportunities for crypto profits.

Justin Sun Faces Backlash Over WLFI Token Unfreeze Request

Justin Sun's request to unfreeze WLFI tokens sparks controversy, impacting market confidence.

Sora Ventures Launches Asia's First $1 Billion Bitcoin Treasury Fund

Sora Ventures Unveils Asia’s F

SEC Faces Backlash Over Missing Texts During Key Crypto Enforcement Period

SEC's record loss raises concerns; investors should navigate market volatility carefully.

Stablecoin Exchange Liquidity Reaches Record High, Binance Holds 67%

Stablecoin exchange liquidity reaches record highs, with Binance capturing 67% market share.

Bitcoin Faces Downward Pressure as Analysts Signal Warning

Bitcoin faces downward pressure as key support levels are breached; investors should be cautious.

Bitcoin Closes August Bearishly, $100K Support in Focus

Bitcoin's August closure raises concerns, with $100K support becoming a critical focus for investors.

U.S. Bank Resumes Bitcoin Custody Services, Opening New Avenues for Institutional Investors

U.S. Bank's resumption of Bitcoin custody services opens up new opportunities for institutional investors.

Trump Family Backs American Bitcoin to Start Trading on Nasdaq Today

American Bitcoin, backed by the Trump family, starts trading on Nasdaq today, attracting widespread interest.

Bitcoin Amsterdam: The Significance of Treasury Acquisition

The treasury acquisition plan at Bitcoin Amsterdam conference attracts market attention, presenting new opportunities for investors.

Pierre Rochard to Discuss Bitcoin's Future at Denver Financial Services Summit

Pierre Rochard will discuss Bitcoin's future at the Denver Summit, highlighting vast industry prospects.

The DAT Delusion: Why Only Bitcoin Should Be on Corporate Balance Sheets

Experts believe that only Bitcoin belongs on corporate balance sheets.

The Potential Impact of Bitcoin Circular Economies on the Market

The rise of Bitcoin circular economies presents new investment opportunities in the market.

Blockchain Revolution: Challenges and Opportunities in User Experience

While blockchain technology has great potential, user experience needs improvement; investors should choose user-friendly trading platforms.

Three Signals That Statistically Predict Bitcoin's Next Big Move

Three signals may indicate the next major move for Bitcoin.

Hyperliquid's New USDH Stablecoin Launch Could Redirect $220M to HYPE Holders

Hyperliquid launches USDH stablecoin, potentially bringing $220M to HYPE holders.

Bitcoin and Ethereum ETFs Lose Nearly $400M, Yet Institutional Interest Remains Strong

Despite nearly $400M in ETF losses, institutional investors maintain confidence in the crypto market.

Dark Web Scam: Fake Ledger Wallet Pages Target Crypto Users

Dark web vendors create fake Ledger wallet pages, urging crypto users to enhance security awareness.